Find the TradeLog subscription that fits your needs...

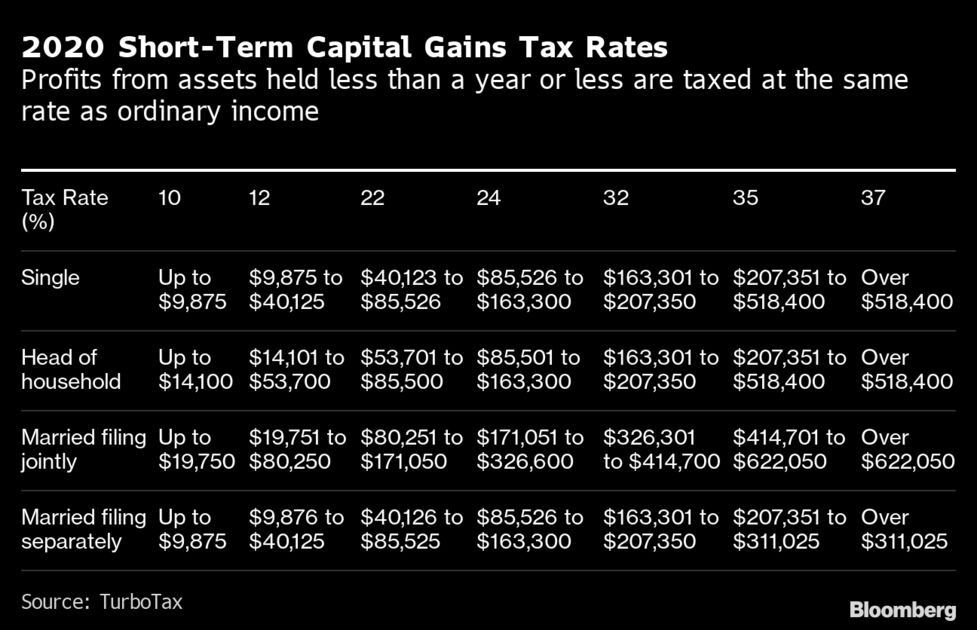

If your capital-gains tax is smaller, that's what the software will tell you to pay. But as a trader who elects mark to market, you should not be paying any capital-gains tax, regardless of the. A pattern day trader, according to the SEC, is a trader who day-trades four or more times within five business days and whose day trades represent more than 6% of their total trading activity. I have a large number of transactions (over 5,000) from daytrading last year, and am not able to import into turbotax software.I've tried various software programs (ie. Trademax) that will import into turbotax as txf file, but am a little ucertain as to the accuracy of. TAS Market Profile is one of the best day trading software programs on the street. There are a couple different packages you can choose from depending on what you are looking for. “TAS Market Profile” by Steve Dahl. More specifically, have you found that products like Turbo Tax and H&R Block cover the unique tax situation that day traders have to deal with, when it comes to filing Schedule C, D, and the Market to Market concept? #1 Jan 15, 2007.

200 Trade Records

Unlimited Broker Accounts

(1) TaxFile Included

Additional TaxFiles can be

purchased - see details below.

FEATURES

Wash Sales, IRA Support

Stocks & Options - Form 8949

Sec 1256 / Futures - Form 6781

Performance Analysis

Technical Support

600 Trade Records

Unlimited Broker Accounts

(1) TaxFile Included

Additional TaxFiles can be

purchased - see details below.

FEATURES

Wash Sales, IRA Support

Stocks & Options - Form 8949

Sec 1256 / Futures - Form 6781

Performance Analysis

Technical Support

1500 Trade Records

Unlimited Broker Accounts

(1) TaxFile Included

Additional TaxFiles can be

purchased - see details below.

FEATURES

Wash Sales, IRA Support

Stocks & Options - Form 8949

Sec 1256 / Futures - Form 6781

Performance Analysis

Technical Support

Sec 475(f) MTM - Form 4797

Start for Free

Start for FreeDay Trading Tax Software Australia

Buy NowUnlimited Trade Records

Unlimited Broker Accounts

(1) TaxFile Included

How Does Tax Work For Day Trading

Additional TaxFiles can be

purchased - see details below.

Best Tax Software For Day Traders

FEATURES

Wash Sales, IRA Support

Stocks & Options - Form 8949

Sec 1256 / Futures - Form 6781

Performance Analysis

Technical Support

Sec 475(f) MTM - Form 4797

Start for Free

Start for FreeNOTES ABOUT TRADELOG SOFTWARE SUBSCRIPTIONS:

Good Day Trading Tax Software

TradeLog Software runs under Microsoft Windows and does not run natively on an Apple Mac.

Some users have been able to run TradeLog on their Mac by purchasing emulation software - see our System Requirements for details.One-Year Subscription Details:

A one-year subscription to any TradeLog subscription record level entitles you to exclusive use of all of the trade accounting and tax functions as described on this web site for a period of one full year from the original date of purchase. Please note: Subscriptions are NOT automatically renewed, and your credit card will not be billed automatically when your subscription expires.One-Year Subscriptions include one TaxFile:

A TaxFile entitles you to create one (1) TradeLog file for:- One (1) Taxpayer ID (SSN or EIN)

- One (1) Tax Year - any year up to the current tax year

- One (1) TaxFile required for each new Taxpayer ID and/or Tax Year

- Total of six (6) TaxFile limit per subscription (unique RegCode)

TradeLog PRO Version Subscriptions for CPAs and Professionals:

Pro Version subscriptions for accountants to use in behalf of their clients allow for:- an unlimited number of additional TaxFiles at $75.00 each

- an unlimited number of Taxpayer IDs (SSN or EIN)

One-Year Subscription Record Levels:

TradeLog tax files are limited to the total number of records (individual buy and sell transactions) for all accounts for a specific taxpayer and tax year.One-Year Subscription Renewals are available at a 20% discount:

To extend your subscription, you may purchase a one-year subscription renewal at a 20% discount up to 30 days after your subscription expires. Discounted renewals extend your subscription one year from your current expiration date. If you wait more than 30 days from your subscription expiration data, the renewals will be at list price.

TradeLog PRO subscriptions do not automatically qualify for 20% renewal. Please request a quote for TradeLog PRO renewal.Use of TradeLog Software:

You may install and use two (2) copiesof TradeLog on two (2) different computers ownedand used by you.